It's impossible to work your way through college nowadays

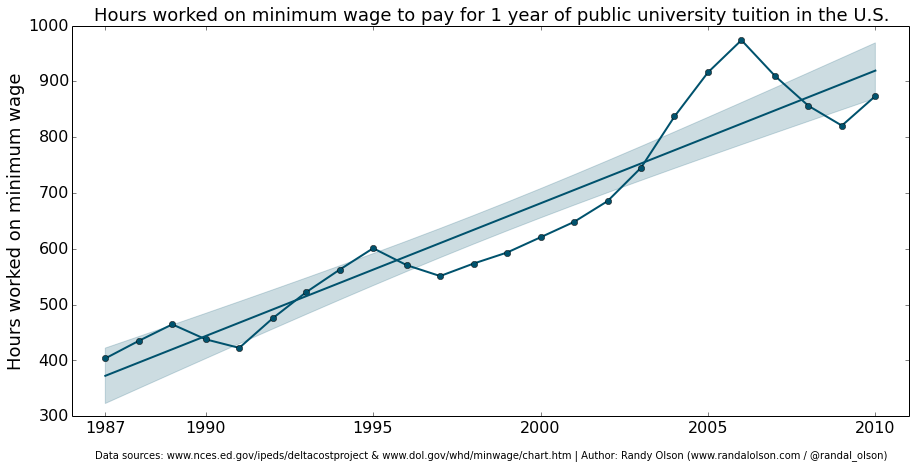

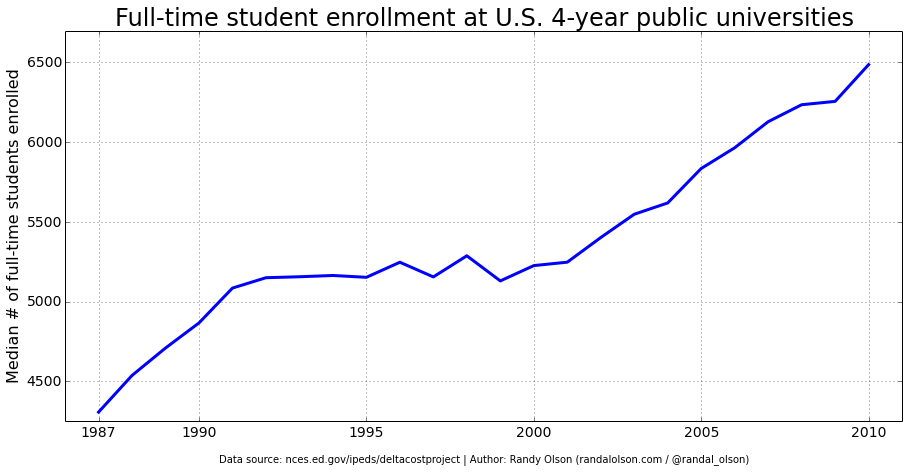

Update (3/29/14): I've written up an analysis of national tuition cost trends in a new blog post. It turns out that Michigan State University's tuition situation isn't uncommon!

Earlier today, I ran across a conversation about how the cost of tuition at Michigan State University (MSU) has changed over the years. I had just finished talking with my grandpa over the phone, and he had spent the latter half of the talk extolling the virtues of working your way through college (without family support), so I was rightly annoyed on the topic already.

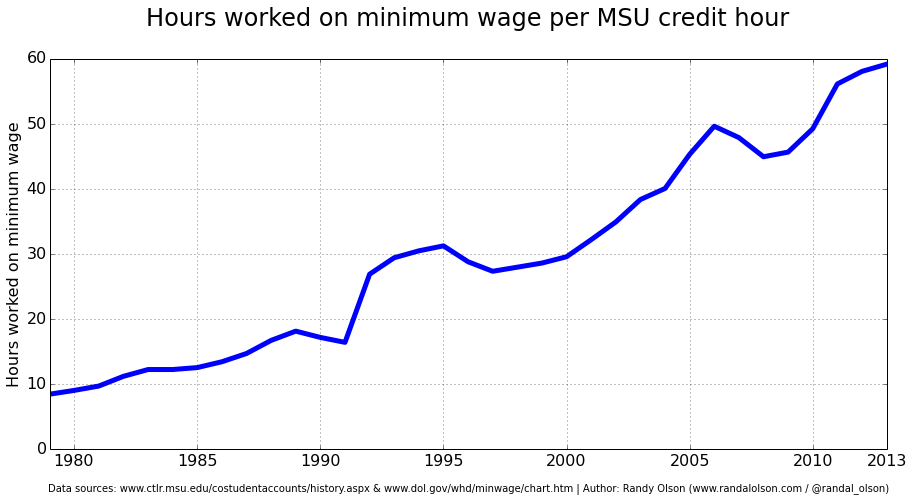

The creator of the discussion pointed to the historical trends for MSU's tuition, and in another comment pointed to the Federal minimum wage trends. If you crunch some of the numbers there, you'll get the chart below showing the number of hours a student must work on minimum wage to pay for a single credit hour at MSU. I'll provide the data set here to save you the number crunching*.

Hours of minimum wage work required to pay for 1 credit hour

What we see is a startling trend: Modern students have to work as much as 6x longer to pay for college than 30 years ago. Given the reports that a growing number of college students are working minimum wage jobs, this spells serious trouble for any student who hopes to work their way through college without any additional support.

Let's crunch a few more numbers to see what a typical year would look like for a student in 1979 and 2013 working her way through college. Most students take 12 credit hours per semester and only attend Fall and Spring semester. That's 24 credit hours per year.

The 1979 student would have to work about 10 weeks at a part-time job (~203 hours) -- basically, they could pay for tuition just by working part-time over the Summer. In contrast, the 2013 student would have to work for 35 ½ weeks (~1420 hours) -- over half the year -- at a full-time job to pay for the same number of credit hours. If you've ever attended college full-time, you know that this is basically impossible.

Perhaps it's no surprise that tuition costs are rising, and college is becoming less and less affordable by the year. Yet somehow, the idea that we can work our way through college still persists. This ethos seems to be the latest generation's version of American Dream: If you work long and hard enough, and if you sacrifice enough, you will eventually graduate college without debt and land your dream job. But with the way this trend is going, it looks like even long and hard hours at work won't even pay off any more.

In short, I'd like my readers to walk away knowing that it's not nearly as easy to work your way through college as it used to be -- stop telling us to do it just because you did a decade or more ago.

* Note about the data: For the minimum wage data, I set the minimum wage to the maximum for the year, even if minimum wage was raised in the later parts of the year (e.g. September). For the tuition data, I averaged the Fall and Spring tuition rates (if available), and only used the tuition rates for students admitted that year. I dropped any entries for Summer tuition on the assumption that most students do not attend Summer semester.

Tags

Related Posts

Dr. Randal S. Olson

AI Researcher & Builder · Co-Founder & CTO at Goodeye Labs

I turn ambitious AI ideas into business wins, bridging the gap between technical promise and real-world impact.